|

|

|

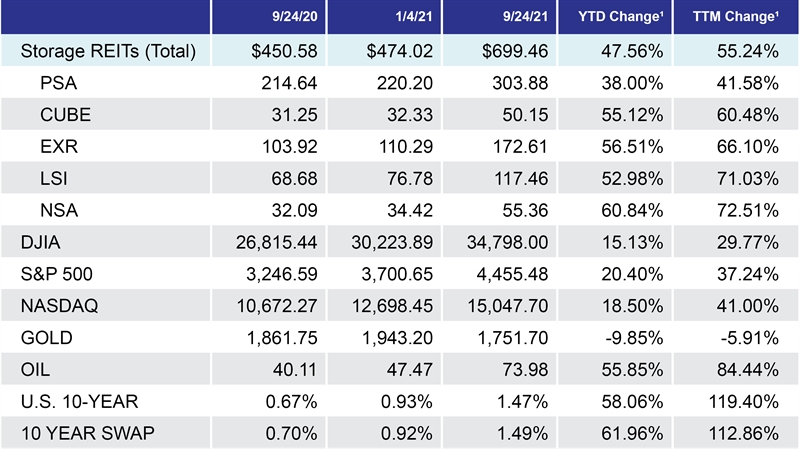

| WEEKLY RATE INFORMATION |

| Market Index |

|

|

|

¹ Excludes dividends

Sources: Yahoo! Finance, U.S. Dept of the Treasury, U.S. EIA, Barchart (SWAADY10.RT), Bloomberg, World Gold Council |

|

|

|

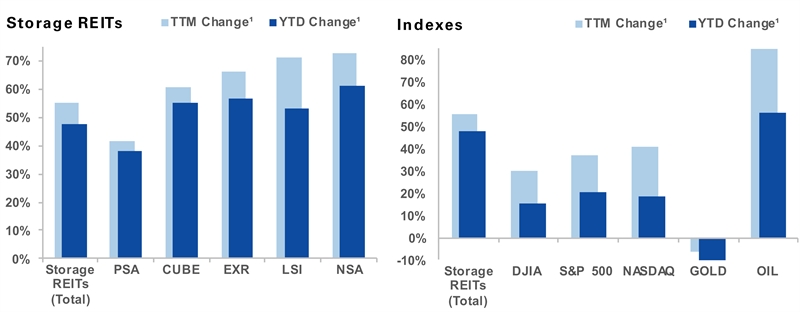

¹ Excludes dividends

Sources: Yahoo! Finance, U.S. Dept of the Treasury, U.S. EIA, Barchart (SWAADY10.RT), Bloomberg, World Gold Council |

|

|

|

|

|

|

| Megacap Tech Getting Hit as Treasury Yields Climb: Markets Wrap |

|

|

|

As Treasury yields pushed higher after a hawkish tilt from the Federal Reserve last week, some of the world’s largest technology companies continued to get hit.

A selloff in bonds sent the rate on the benchmark 10-year note briefly above 1.5% -- a level not seen since June. That’s prompted the tech-heavy Nasdaq 100 of powerhouses such as Apple Inc. and Microsoft Corp. to underperform major equity benchmarks on Monday. Meantime, economically sensitive companies -- like small caps, energy and financial shares -- advanced. |

|

|

|

|

|

| Stock market news live updates: Stocks trade mixed as investors eye DC votes |

|

|

|

Stocks were mixed Monday as investors closely monitored developments in Washington, D.C., as lawmakers rush to try and avert a government shutdown and advance a bevy of new measures.

The S&P 500 fell to give back some gains after the blue-chip index posted a three-day winning streak at the end of last week. The Nasdaq lagged with a drop of more than 0.8% as Treasury yields climbed. The benchmark 10-year yield extended last week's gains to top 1.48%, reaching its highest level since June as optimism over the economic recovery mounted. The Dow added about 0.1%. |

|

|

|

|

|

|

|

|

|

|

|

|

1700 Post Oak Blvd, 2 BLVD Place Suite 250

Houston, TX 77056

t 713-626-8888 |

|

|

|

|

|

Unsubscribe

|

|

|

1700 Post Oak Blvd, 2 BLVD Place Suite 250, Houston, TX 77056 t 713-626-8888

|

All information contained in this publication is derived from sources that are deemed to be reliable. However, Newmark has not verified any such information, and the same constitutes the statements and representations only of the source thereof, and not of Newmark. Any recipient of this publication should independently verify such information and all other information that may be material to any decision that recipient may make in response to this publication, and should consult with professionals of the recipient's choice with regard to all aspects of that decision, including its legal, financial, and tax aspects and implications. Any recipient of this publication may not, without the prior written approval of Newmark, distribute, disseminate, publish, transmit, copy, broadcast, upload, download, or in any other way reproduce this publication or any of the information it contains. This document is intended for informational purposes only and none of the content is intended to advise or otherwise recommend a specific strategy. It is not to be relied upon in any way to predict market movement, investment in securities, transactions, investment strategies or any other matter.

©2024 Newmark. All Rights Reserved.

|

|

|

|

|