Welcome to

Industrial Insights, a biweekly recap of recent happenings in the industrial space and what to watch for in the future. If you didn't receive this newsletter directly and would like to, please

click here to subscribe.

This installment includes commentary on potential implications for the industrial market under a new administration, recent occupier sentiment, 3Q industrial real estate stats and more.

Understanding the evolving landscape of industrial real estate involves examining the policy changes and economic factors that can significantly influence market dynamics. Key areas where policy shifts may occur with potential direct and indirect impacts for the industrial real estate market include but are not limited to: tariffs, immigration, deregulation, and energy. Ultimately, how the economy and the consumer perform is the most important driver of demand for industrial space. Newmark Research predicts a 50% probability of a soft-landing scenario for the next 12 months, and only a 10% chance of a hard landing. For more on Newmark's economic scenarios forecasts, read the

3Q24 State of the U.S. Capital Markets report.

Tariffs: Companies will weigh storage costs against potential tariffs but an uptick in U.S. imports for non-time-sensitive goods in the short term is all but certain. In an illustrative example, as

WSJ chronicles, Breville’s CEO said on 11/7, “We will continue our inventory build in the U.S., unabated, likely until the increased tariffs are enforced.” Uncertainty around potential tariffs is compounded in the short term with the

growing potential for another East/Gulf Coast dockworker strike in January 2025, according to CNBC. While the short-term impacts point to reduced slack in warehousing capacity, longer-term implications remain contingent on the magnitude, breadth, and timing of trade policy changes. Companies are implementing strategic shifts in their supply chains driven by a broader matrix of factors, including tariff considerations. A handful of recent examples:

Immigration: Changes in immigration policies could have implications for industrial-supporting sectors such as construction,

which is facing a 500,000-worker shortage, according to Business Insider, and manufacturing, where a

recent report from UKG Workforce Institute found that 69% of manufacturers say labor shortages impact their ability to meet production demands. Companies may accelerate efforts to leverage technology, automation, and re-skill the workforce,

although investment will align with production needs, per the WSJ. Modern logistics space is most accommodative to these types of investments.

Deregulation: Deregulation is likely to be a key theme of the new administration, affecting sectors from climate policy and energy to finance,

according to Reuters. Against a backdrop of specific sector considerations and broader macroeconomic implications, deregulation could catalyze growth in business investment

according to experts quoted by NBC. Major real estate developments may require adaptation to shifting federal and state/regional regulatory changes.

Energy:

U.S. energy production hit a new record in 2023,

but power consumption will rise to record highs in 2024 and 2025, according to Reuters. Power availability and transmission is a critical issue, exacerbated in part by growth in power-hungry industrial and related projects.

This rundown from Reuters outlines ways the new administration could take action on this front. Regarding the IRA, policies around electric vehicle tax incentives and emissions legislation are most in question,

according to the New York Times.

For occupiers, a leading indicator of sentiment saw a post-election surge in confidence

, according to Chief Executive. 55% of CEOs plan to increase capital expenditures over the next 12 months, up from 37% in October (+46%). That is the highest level since March 2022—a testament to the renewed sense of clarity CEOs say they now have over the near term.

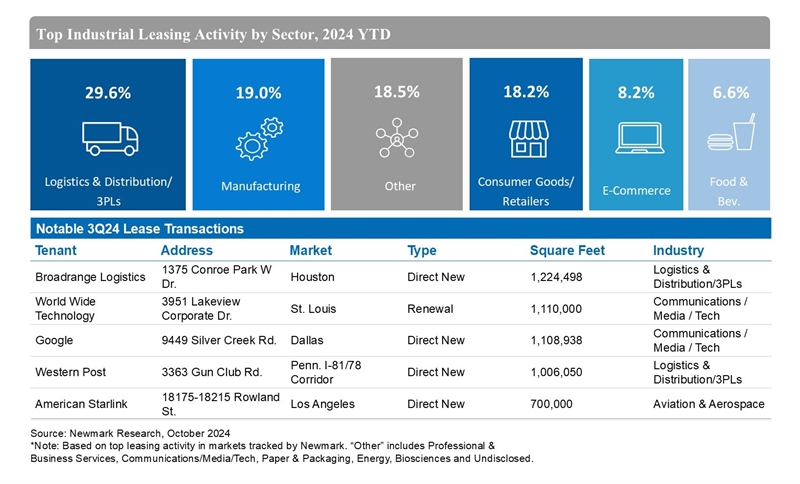

Looking at what sectors have driven industrial leasing this year, the logistics/3PL segment has represented 30% of top leasing activity year to date, consecutively expanding market share every quarter this year, representing 38% of 3Q24 top leasing activity. The “Other” category has been buoyed this year primarily by the Tech sector, as hyperscalers and related service firms are leasing warehouse space to support data center build-out.

Finally,

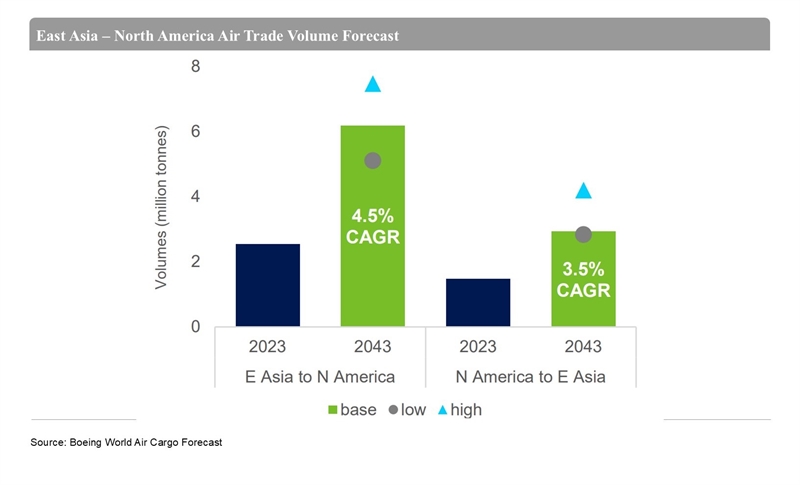

sharing an interesting recent report from Boeing on the air cargo industry outlook. Though less than 1% of global trade volumes are transported via air, these goods tend to be perishable, high-value, or time-sensitive, and collectively generate ~35% of world trade value. Air cargo volumes between East Asia – North America, collectively representing the largest share of global air cargo traffic, are expected to more than double by 2043.

Cheers,

Lisa DeNight

Managing Director, U.S. Industrial Research